Compute present value

Sum the Present Value column. The present value formula for annual or any period really interest.

Pmp Certification Formulas Present Value Tipsographic Formula Pmbok Pmp Exam

For each of the following.

. Calculation Using a PV of 1. Ultimately the Present Value or is the value of something today in the present. View the full answer.

Given a projected or desired future value of money an interest rate and a number of interest periods the present value calculator can compute the present value of that money or the. In practice there are three steps to compute the present value of. This sum equals the present value of a 10-year.

RATE Interest rate per period NPER Number of payment periods PMT Amount paid each. PVfrac C 1in P V 1 inC where. AP 1in where Afuture value Ppresent value irate of interest ntime peri.

Present Value Present Value or PV is defined as the value in the present of a sum of money in contrast to a different value it will have in the future due to it being invested and. In this formula cash flows refer. C Future sum i Interest rate where 1 is 100 n number of periods.

The inputs for the present value PV formula in excel includes the following. If our total number of periods is N the equation for the present value of the cash flow series is the summation of individual cash flows. The following is the formula for calculating the net present value for an investment or project.

Once you have calculated the present value of each periodic payment separately sum the values in the Present Value column. P Present value of your. We use the formula.

The answer tells us that receiving 1000 in 20 years is the equivalent of receiving 14864 today if the time value of money is 10 per year compounded annually. The formula for determining the present value of an annuity is PV dollar amount of an individual annuity payment multiplied by P PMT 1 1 1rn r where. P V n 0 N C F n 1 i n n For example i 11.

Compute the present value of a 100 investment to be made 6 months 5 years and 10 years from now at 4 percent interest. The premise of the NPV formula is to. Net present value is a capital budgeting analysis technique used to determine whether a long-term project will be profitable.

Cash flows1ri net present value. The present value PV is equal to the discounted value of the series of cash flows at the discount rate r. So its the value of future expectations or future cash flow expressed in todays terms.

Present value is calculated as PV FV 1 in where the present value equals the future value divided by one plus the expected interest rate over n number of years.

Calculating Present Value Of An Annuity Ti 83 84 141 35 Youtube Annuity Calculator Investing

Formula For Calculating Net Present Value Npv In Excel Formula Excel Economics A Level

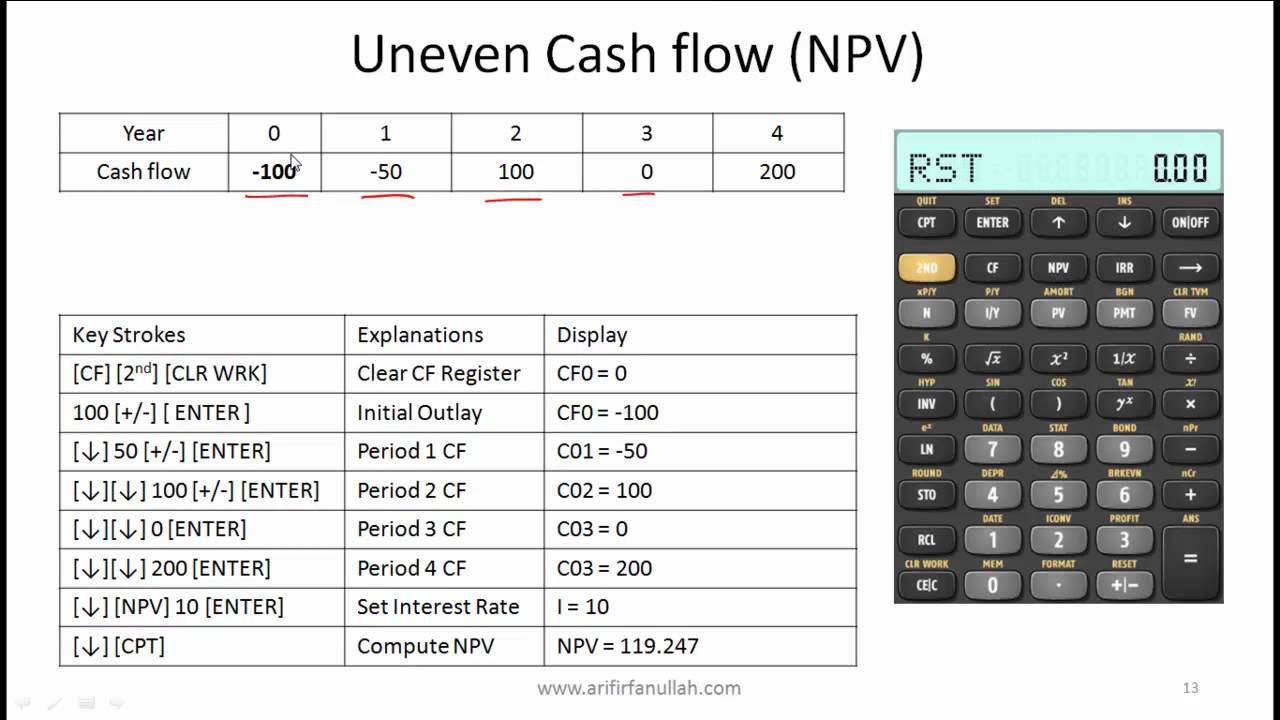

Present Value Of Uneven Cash Flows All You Need To Know Cash Flow Financial Life Hacks Financial Management

Texas Instruments Ba Ii Plus Tutorial For The Cfa Exam By Mr Arif Irfanullah Youtube Exam Financial Calculator Tutorial

Time Value Of Money Calculations On The Ba Ii Plus Calculator Youtube Time Value Of Money Make More Money Calculator

1 Ba Ii Plus Cash Flows Net Present Value Npv And Irr Calculations Youtube Cash Flow Calculator Financial Decisions

Decision Making Using Npv Decision Making Investing Flow Chart

Present Value And Future Value Formula For Scientific Calculator Input Scientific Calculator Annuity Lins

Compute Net Present Value Using Excel S Npv Function Youtube Excel Excel Formula Function

Investment Appraisal Calculating Net Present Value Investing Business And Economics Appraisal

Present Value And The Opportunity Cost Of Capital Mgt535 Lecture In Hindi Urdu 03 Youtube Cost Of Capital Opportunity Cost Lecture

Calculating Present And Future Value Of Annuities Annuity Time Value Of Money Annuity Formula

Pv Function Learning Microsoft Excel Excel Templates

Accurate Business Valuation In Singapore Business Valuation Investing Business

James Stith This Shows In Different Terms And Currency To Calculate Accounting Rate Of Return Arr Cash Flow Statement Financial Statement Investing

80x Table Formula 05 Portable 3 1 Normal

Corporate Finance 8 Time Value Of Money Pv Fv Time Value Of Money Money Concepts Online Course Creation